Form 433 D Installment Agreement

Guitar Pro V6.1.1 R10791. You will mail Form 433-D to the IRS at the address on the letter that came with it or the address shown in the 'For Assistance' box on the front of the form. Where do I mail my 433-D agreement form. IRS gave me a address.Put I couldn't understand on the phone.They said IRS ACS and something else and then PO box 8208 didn't get.

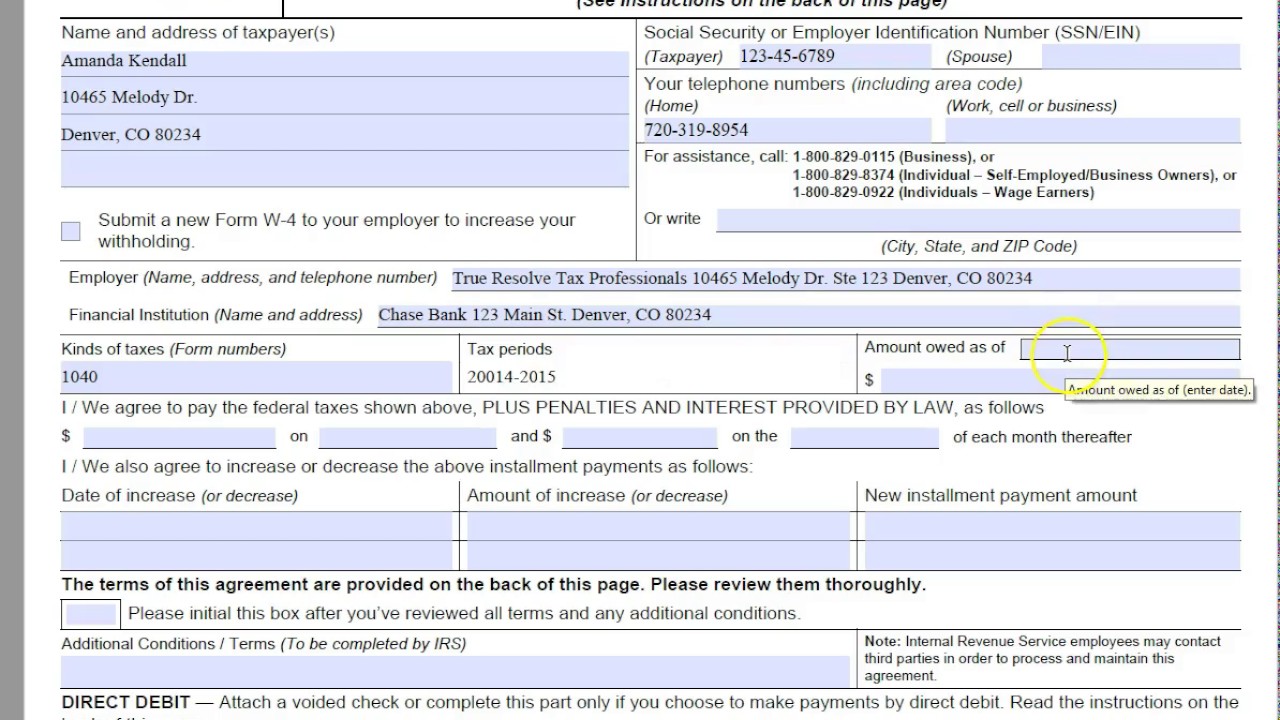

Installment Agreement Request IRS Form 433D is one of two IRS Forms used to set up an installment agreement request with the IRS. To set up an with IRS Form 433D, you need to fill in the required information in the spaces provided including your name (spouse’s name if you filed a joint return), address, social security number, name and address of employer and name and address of your financial institution. Also important on IRS Form 433D, you need to identify the kind of taxes, tax periods you owed and the total. You need to determine the amount to pay (monthly payment needs to be sufficient to pay tax balance within IRS timeframes) and the day you prefer to make your payment. How To Install Pfsense Packages Offline more. The payment date must be the same day each month from the 1st to the 28th. There is a section where you can increase/decrease your payment amount and date(s) you wish to increase/decrease the payment.